Portfolio Example

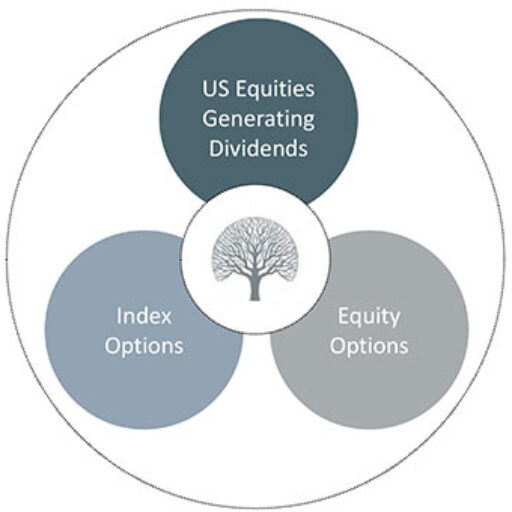

EQUITY INCOME ARBITRAGE FUND

Fund Summary

Primary US Large Cap with Consistent Dividend Policy

The portfolio is expected to consist primarily of liquid equities and options of US large cap companies that have historically maintained a consistent dividend policy and low corporate debt.

Seeks Inefficiencies in Pricing

The Fund seeks to generate returns by taking advantage of inefficiencies in the pricing of options of non-volatile underlying businesses.

Investment Process

- Diversified Basket of Large Cap Stocks less than < 5X Debt/EBITDA

- Vetted for very stable historical dividend policy and debt levels

- Greater than Market Dividend Payout

- Dividends are Funded from Free Cash Flow

- Equities are hedged individually

- Overall Portfolio can be additionally hedged using index puts to limit significant downside market events.

Portfolio & Risk Management

- Target Returns: 8-12% annualized net returns

- Positions: 20+ with maximum exposure of 5% to any one holding

- Beta: 0.5 to 0.6 beta to S&P500

- Sector Exposure: 30% maximum

- Sector Diversification: Transportation, Industrials, Utilities, Consumer Goods, Large Value Technology, Large Healthcare/Pharm